SUBHEAD: What might happen to the USA if the SNAP card refills and Social Security checks stopped coming.

By James Kunstler on 17 April 2107 for Kunstler.com -

(http://kunstler.com/clusterfuck-nation/buy-the-dip/)

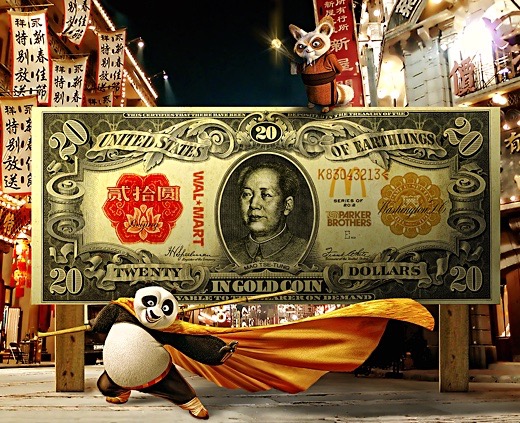

Image above: Illustration ofa gold backed Chinese twenty "dollar" bill that could replace the US dollar in international trade. From (http://www.thedailyeconomist.com/2017/03/russia-may-soon-take-new-swift-type.html).

The military frolics of spring have distracted the nation’s attention from the economic and financial dynamics that pose the ultimate mortal threat to business as usual.

Note the distinction between economic and financial.

The first represents real activity in this Land of the Deal: people doing and making.

The second, finance, used to be a minor branch — only about five percent — of all the doing in the days of America’s putative bigliest greatitude.

The task of finance then was limited and straightforward: to manage the allocation of capital for more doing and making. The profit in that enabled bankers to drive Cadillacs instead of Chevrolets, but not much more.

These days, finance is closer to 40 percent of all the doing in America, and it is not about making anything, but getting more than its share of “money” — whatever that is now — and what “money” mostly is is whatever the people engaged in finance say it is, for instance, Fannie Mae bonds representing millions of sketchy loans for houses of vinyl and strand-board built in places with no future… or stock issued by the Tesla corporation… or the sovereign IOUs of the US Treasury.

The list of things that pretend to be “money” these days would be long and shocking and the sheer churn of these instruments among the banks and markets “produces” the fabled “revenue streams” beloved of The Wall Street Journal.

What happens when the world discovers that these instruments (securities and their derivatives) represent falsely? Why, bigly trouble.

And this is the season we’re moving into as the dogwoods blaze: the season of the re-discovery of actual value.

For those of you gloating over last week’s demonstrations of US Big Stick-ism, be warned that our military shenanigans have given China and Russia every reason to discipline this country by undermining the international standing of the dollar.

They’ve been preparing for this very deliberately for years: constructing an alternative to the US-sponsored SWIFT international payment system, stockpiling thousands of tons of gold, building trade partnerships to circumvent US dominated syndicates.

Before the month of April is out, they’ll “pull the trigger” on new voting arrangements in the International Monetary Fund that will reduce the financial power of the US and the Eurozone, especially in the oil trade.

Around the same moment, America will wake up to the awful reality of the debt ceiling. This petard has been ticking the whole time that the political bureaucracy of Washington has wasted its mojo on the quixotic crusade to blame Russia for the 2016 election outcome.

Congress will return from the Easter recess to discover that they have a few mere days to debate and resolve the debt ceiling problem — that is, to raise it so the country can borrow more “money” — or else they’ll be faced with a shut-down of government operations, including their own generous emoluments.

It’s a good thing (for them) that they have plenty of walking-around money from the mysterious perqs of government service, but the rest of America doesn’t have $500 to pay for a new set of tires or the extraction of an abscessed molar.

Some readers may have long wondered what might happen in this country if the SNAP card refills and social security checks stopped coming. Perhaps we’re about to find out. Congress might find itself in a painfully tight spot.

The Democrats would like nothing better than to let this drag on for a while in order to humiliate, and perhaps finish off, their arch-nemesis, the Golden Golem of Greatness.

Many Republicans have a religious-strength ideological aversion to increasing the already appalling US debt load. The prospects are not bright for a quick-and-easy resolution to this quandary.

The IMF voting re-set and the debt ceiling quagmire have the power to disrupt many of the arrangements that allow the banks and markets to continue pretending that their stuff has value.

When that consensus trance snaps, President Trump may find himself in the unhappy position of having to declare a bank holiday.

Unlike the usual holidays in America, there will no Easter Bunny, no Jack-o-lanterns, no Santa Claus.

Just empty supermarket shelves and pissed-off people marshaling in the WalMart parking lots with flaming brands and espontoons.

.

By James Kunstler on 17 April 2107 for Kunstler.com -

(http://kunstler.com/clusterfuck-nation/buy-the-dip/)

Image above: Illustration ofa gold backed Chinese twenty "dollar" bill that could replace the US dollar in international trade. From (http://www.thedailyeconomist.com/2017/03/russia-may-soon-take-new-swift-type.html).

The military frolics of spring have distracted the nation’s attention from the economic and financial dynamics that pose the ultimate mortal threat to business as usual.

Note the distinction between economic and financial.

The first represents real activity in this Land of the Deal: people doing and making.

The second, finance, used to be a minor branch — only about five percent — of all the doing in the days of America’s putative bigliest greatitude.

The task of finance then was limited and straightforward: to manage the allocation of capital for more doing and making. The profit in that enabled bankers to drive Cadillacs instead of Chevrolets, but not much more.

These days, finance is closer to 40 percent of all the doing in America, and it is not about making anything, but getting more than its share of “money” — whatever that is now — and what “money” mostly is is whatever the people engaged in finance say it is, for instance, Fannie Mae bonds representing millions of sketchy loans for houses of vinyl and strand-board built in places with no future… or stock issued by the Tesla corporation… or the sovereign IOUs of the US Treasury.

The list of things that pretend to be “money” these days would be long and shocking and the sheer churn of these instruments among the banks and markets “produces” the fabled “revenue streams” beloved of The Wall Street Journal.

What happens when the world discovers that these instruments (securities and their derivatives) represent falsely? Why, bigly trouble.

And this is the season we’re moving into as the dogwoods blaze: the season of the re-discovery of actual value.

For those of you gloating over last week’s demonstrations of US Big Stick-ism, be warned that our military shenanigans have given China and Russia every reason to discipline this country by undermining the international standing of the dollar.

They’ve been preparing for this very deliberately for years: constructing an alternative to the US-sponsored SWIFT international payment system, stockpiling thousands of tons of gold, building trade partnerships to circumvent US dominated syndicates.

Before the month of April is out, they’ll “pull the trigger” on new voting arrangements in the International Monetary Fund that will reduce the financial power of the US and the Eurozone, especially in the oil trade.

Around the same moment, America will wake up to the awful reality of the debt ceiling. This petard has been ticking the whole time that the political bureaucracy of Washington has wasted its mojo on the quixotic crusade to blame Russia for the 2016 election outcome.

Congress will return from the Easter recess to discover that they have a few mere days to debate and resolve the debt ceiling problem — that is, to raise it so the country can borrow more “money” — or else they’ll be faced with a shut-down of government operations, including their own generous emoluments.

It’s a good thing (for them) that they have plenty of walking-around money from the mysterious perqs of government service, but the rest of America doesn’t have $500 to pay for a new set of tires or the extraction of an abscessed molar.

Some readers may have long wondered what might happen in this country if the SNAP card refills and social security checks stopped coming. Perhaps we’re about to find out. Congress might find itself in a painfully tight spot.

The Democrats would like nothing better than to let this drag on for a while in order to humiliate, and perhaps finish off, their arch-nemesis, the Golden Golem of Greatness.

Many Republicans have a religious-strength ideological aversion to increasing the already appalling US debt load. The prospects are not bright for a quick-and-easy resolution to this quandary.

The IMF voting re-set and the debt ceiling quagmire have the power to disrupt many of the arrangements that allow the banks and markets to continue pretending that their stuff has value.

When that consensus trance snaps, President Trump may find himself in the unhappy position of having to declare a bank holiday.

Unlike the usual holidays in America, there will no Easter Bunny, no Jack-o-lanterns, no Santa Claus.

Just empty supermarket shelves and pissed-off people marshaling in the WalMart parking lots with flaming brands and espontoons.

.

No comments :

Post a Comment